Tribunal slams MP Abdul Wahab, orders ministry probe into Indus Motors

Follow TNM’s WhatsApp channel for news updates and story links.The Kochi bench of the National Company Law Tribunal (NCLT) has directed the Ministry of Corporate Affairs (MCA) to initiate a detailed investigation into Indus Motors, Kerala’s largest Maruti Suzuki dealer, led by Rajya Sabha MP Pulikkal Veettil Abdul Wahab, over allegations of fund diversion, unauthorised transactions, and oppression of minority shareholders. PV Abdul Wahab (75) is a senior Indian Union Muslim League leader and among Kerala’s wealthiest MPs.In its 132-page order passed on September 3, the tribunal came down heavily on Wahab, who holds a 59% stake in Indus Motors and serves as its managing director, ruling that “acts of oppression and mismanagement have occurred” in the company. The NCLT appointed former Kerala High Court judge Justice S Siri Jagan as the administrator to ensure “proper governance, transparency, and effective functioning” during the probe. The MCA has been tasked with investigating the company’s affairs from FY 2011–12 onwards.A petition was filed in 2020 by four minority shareholders – TP Anilkumar, TP Ajithkumar, TP Sarada, and Anju Madhav – who together hold 20% of the company’s equity. They accused Wahab and his relatives of financial impropriety, misuse of company funds, and self-enrichment at the cost of minority stakeholders.A key charge pertained to the company’s Rs 9.98 crore investment in the IPO of Aster DM Healthcare in 2018. The NCLT held this investment to be “a clear ultra vires act, and not merely a business decision,” pointing out that Wahab and his family already held shares in Aster DM, and Wahab was a close associate of promoter Dr Azad Moopen. The tribunal ordered Wahab and other family members to refund the loss of Rs 2.37 crore suffered by Indus Motors, along with 12% annual interest.The bench also ruled that Wahab had illegally continued as managing director despite crossing the statutory age limit of 70 in July 2020, without a special resolution as required under The Companies Act. “All types of remuneration and monetary benefits… shall stand refunded to the company,” the order said, directing Wahab to return salaries, fees, and management fees received after 2020 with 6% interest. His sons Ajmal and Afdhel, who remained on the board despite disqualification under law, must also return remuneration drawn during that period.The forensic audit further revealed that Indus Motors had extended over Rs 52 crore in interest-free loans to Wahab and his relatives without board approval, and engaged in related party transactions worth more than Rs 82 crore in seven years. Some properties purchased with company funds were registered in the names of Wahab’s relatives and leased back at inflated rents. The tribunal observed that such practices reflected a “pattern of mismanagement and oppression” detrimental to minority shareholders.The tribunal also found that between 2011 and 2018, over Rs 82 crore worth of related party transactions were carried out without proper approvals or disclosures, including deals with a prominent jewelry brand. It also noted repeated failures, including no whole-time company secretary, no audit committee, auditor resignations due to lack of records, and internal audits exposing irregularities. Further, it was found that around 85% of profits were diverted to majority shareholders via rentals, interest, and management fees. Under Wahab’s leadership, Indus Motors also accumulated over Rs 440 crore in liabilities to banks and non-banking finance companies (NBFCs) and losses exceeding Rs 62.88 crore.It also noted political linkages in fund diversion, citing a forensic audit finding that Rs 33.5 crore was paid to a political associate, of which only Rs 13 crore was returned. “The corresponding entry against the name of Respondent No 2 [PV Abdul Wahab] makes the issue more serious and indicates that everything occurred with his concurrence and involvement,” the order remarked.While directing the MCA to probe Indus Motors’ affairs from FY 2011–12 onwards, the tribunal gave Wahab and his family three months to refund the amounts, failing which the company could initiate redemption of their shares to recover dues.Retired Justice Jagan will now control all appointments and removals of directors, oversee employees, and vet asset sales, borrowings, investments, and related party deals. His consent is binding on the board, and he will receive Rs 4 lakh a month in salary from Indus Motors, and enjoys immunity for good faith decisions. He is directed to file quarterly progress reports with the tribunal.The tribunal also ordered:Wahab and family to refund dues within three months, failing which their shares may be redeemed to recover amounts.Indus Motors to issue a public notice clarifying it is not part of Wahab’s Bridgeway or Peeves Group.Constitution of a proper CSR Committee under the Companies Act for future compliance.On the minority petitioners’ claims, the bench ruled that “majo

Follow TNM’s WhatsApp channel for news updates and story links.

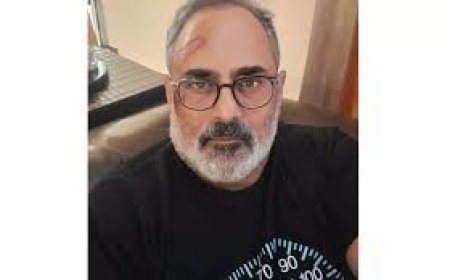

THE Kochi bench of the National Company Law Tribunal (NCLT) has directed the Ministry of Corporate Affairs (MCA) to initiate a detailed investigation into Indus Motors, Kerala’s largest Maruti Suzuki dealer, led by Rajya Sabha MP Pulikkal Veettil Abdul Wahab, over allegations of fund diversion, unauthorised transactions and oppression of minority shareholders.

PV Abdul Wahab (75) is a senior Indian Union Muslim League leader and among Kerala’s wealthiest MPs.

In its 132-page order passed on September 3, the tribunal came down heavily on Wahab, who holds a 59% stake in Indus Motors and serves as its managing director, ruling that “acts of oppression and mismanagement have occurred” in the company.

The NCLT appointed former Kerala High Court judge Justice S Siri Jagan as the administrator to ensure “proper governance, transparency, and effective functioning” during the probe. The MCA has been tasked with investigating the company’s affairs from FY 2011–12 onwards.

A petition was filed in 2020 by four minority shareholders – TP Anilkumar, TP Ajithkumar, TP Sarada, and Anju Madhav – who together hold 20% of the company’s equity. They accused Wahab and his relatives of financial impropriety, misuse of company funds, and self-enrichment at the cost of minority stakeholders.

A key charge pertained to the company’s Rs 9.98 crore investment in the IPO of Aster DM Healthcare in 2018. The NCLT held this investment to be “a clear ultra vires act, and not merely a business decision,” pointing out that Wahab and his family already held shares in Aster DM, and Wahab was a close associate of promoter Dr Azad Moopen.

The tribunal ordered Wahab and other family members to refund the loss of Rs 2.37 crore suffered by Indus Motors, along with 12% annual interest.

The bench also ruled that Wahab had illegally continued as managing director despite crossing the statutory age limit of 70 in July 2020, without a special resolution as required under The Companies Act. “All types of remuneration and monetary benefits… shall stand refunded to the company,” the order said, directing Wahab to return salaries, fees, and management fees received after 2020 with 6% interest.

His sons Ajmal and Afdhel, who remained on the board despite disqualification under law, must also return remuneration drawn during that period.

The forensic audit further revealed that Indus Motors had extended over Rs 52 crore in interest-free loans to Wahab and his relatives without board approval, and engaged in related party transactions worth more than Rs 82 crore in seven years. Some properties purchased with company funds were registered in the names of Wahab’s relatives and leased back at inflated rents. The tribunal observed that such practices reflected a “pattern of mismanagement and oppression” detrimental to minority shareholders.

The tribunal also found that between 2011 and 2018, over Rs 82 crore worth of related party transactions were carried out without proper approvals or disclosures, including deals with a prominent jewelry brand. It also noted repeated failures, including no whole-time company secretary, no audit committee, auditor resignations due to lack of records, and internal audits exposing irregularities.

Further, it was found that around 85% of profits were diverted to majority shareholders via rentals, interest, and management fees. Under Wahab’s leadership, Indus Motors also accumulated over Rs 440 crore in liabilities to banks and non-banking finance companies (NBFCs) and losses exceeding Rs 62.88 crore.

It also noted political linkages in fund diversion, citing a forensic audit finding that Rs 33.5 crore was paid to a political associate, of which only Rs 13 crore was returned. “The corresponding entry against the name of Respondent No 2 [PV Abdul Wahab] makes the issue more serious and indicates that everything occurred with his concurrence and involvement,” the order remarked.

While directing the MCA to probe Indus Motors’ affairs from FY 2011–12 onwards, the tribunal gave Wahab and his family three months to refund the amounts, failing which the company could initiate redemption of their shares to recover dues.

Retired Justice Jagan will now control all appointments and removals of directors, oversee employees, and vet asset sales, borrowings, investments, and related party deals. His consent is binding on the board, and he will receive Rs 4 lakh a month in salary from Indus Motors, and enjoys immunity for good faith decisions. He is directed to file quarterly progress reports with the tribunal.

The tribunal also ordered:

-

Wahab and family to refund dues within three months, failing which their shares may be redeemed to recover amounts.

-

Indus Motors to issue a public notice clarifying it is not part of Wahab’s Bridgeway or Peeves Group.

-

Constitution of a proper CSR Committee under the Companies Act for future compliance.

On the minority petitioners’ claims, the bench ruled that “majority status, by itself, is not sufficient to demand or enforce the exit of minority shareholders,” rejecting Wahab’s plea to buy them out. Instead, it suggested mediation within six months, failing which the findings of the order would prevail.

It also declined to act on allegations of a Rs 100 crore diversion to IndusGo Mobility and Technology, citing a lack of documentary proof beyond media reports.

NCLT stressed that “the interests of the company and its stakeholders must be safeguarded, free from undue influence.”